Insurance Premium Tax Vat

Its applied at two rates. Although VAT is the most common form of tax its not applicable on insurance thats where IPT comes in There are two rates of IPT.

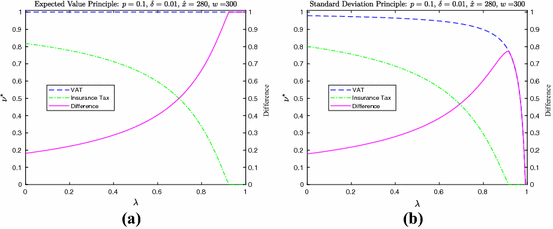

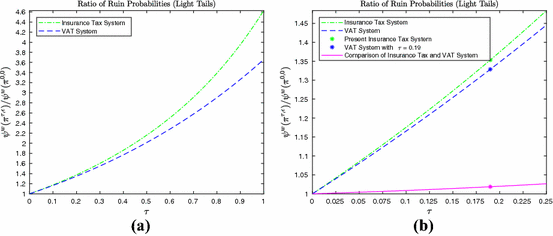

The Impact Of Insurance Premium Taxation Springerlink

The Impact Of Insurance Premium Taxation Springerlink

You can set up a new tax rate but this new IPT rate will automatically be included within the VAT return figures.

Insurance premium tax vat. A higher rate tax of 175 was introduced in 1997 for insurance policies which offered breakdown cover as well as travel and product insurance. The higher rate remains at 20. Are there other indirect taxes.

Its a tax thats applied to insurance premiums received under taxable insurance contracts. INSURANCE PREMIUMS Insurance and reinsurance services Rate. Types of indirect taxes VATGST and other indirect taxes.

9222020 Insurance premium tax is a tax on the premium you pay when you are buying insurance for your car. One such feature is that where a broker is involved in the supply chain the commercial arrangements may actually result in the broker bearing the cost of the IPT even though it is the underwriter that is liable to account for it to HMRC. 1252013 Notice IPT1 Insurance Premium Tax Notice 70136 Insurance If you would like further help you can ring the VAT Helpline on Telephone.

Introduced in 1994 the standard IPT rate was 25 rising to 12 in the past 23 years. Insurance Premium Tax IPT is not VAT but you might think of it as VAT for insurance. If the invoice is from the insurance company it will show insurance premium tax IPT and it will be VAT exempt.

Insurance Premium Tax IPT is a complex tax with a number of unusual features. The obligation to pay this tax depends on the country where arise the insurance risk. After your insurance provider collects the premium from you the tax is paid directly to the Government.

A standard rate currently 95 which is applied to pet motor mobile contents buildings and private medical insurance. A current standard rate of 12. 9192019 What is Insurance Premium Tax.

Value-Added Tax Consolidation Act 2010 VATCA 2010 Ref. 362020 What is Insurance Premium Tax. 9142008 Insurance is not always exempt from VAT.

Exemptions from insurance premium tax There are a number of exemptions from. The insurance premium tax rate is 21 on general insurance premium and 21 on the additional cost for services related to the insurance. Including agency services in relation to.

242021 Insurance Premium Tax was introduced in 1994 with the Government looking for a way to impose greater taxing of the insurance industry which isnt subjected to traditional VAT. 12312020 Insurance transactions are exempt from VAT. 9282016 Although VAT is the most common form of tax its not applicable on insurance thats where IPT comes in There are two rates of IPT.

There are currently two main reduced rates of VAT. What is the insurance premium tax rate. We are a removal firm who includes insurance premiums on the sales invoices this attracts IPT tax at 12 on the insurance amounts this needs to be recorded on the balance sheet as it is then paid over to the insurer.

You need to know about it as it can increase the cost of. Currently there are two rates of IPT. However if the insurance is recharged to you by the policy holder and the policy holder is VAT registered then they must charge you VAT but not IPT.

There are two rates of IPT standard and high. 0300 200 3700 Monday to Friday 8am to 6pm. A standard rate of 12 and a higher rate of 20.

3162020 Insurance Premium Tax IPT is a government-introduced tax on insurance policies including car home travel and pet which every insurance provider has to charge. Value-added tax VAT VAT is charged at the standard rate of 23 temporarily reduced to 21 which is expected to end on 28 February 2021 on the supply of the majority of goods and services in the course or furtherance of business. Insurance Premium Tax IPT is a tax on insurers like VAT that applies to most general UK insurance premiums 1 or potential premiums.

Normally VAT cannot be recovered on goods and services bought in to make exempt supplies see paragraph 71 for more information. Insurance premium tax Due to current legal regulations the insurance companies which are providing activity in country other than Poland may be obliged to pay insurance premium tax or other payments called parafiscal charge. What supplies are subject to VAT.

15 Free Freelance Writer Quotation Templates Ms Office Documents Quotations Quote Template Job Quotes

15 Free Freelance Writer Quotation Templates Ms Office Documents Quotations Quote Template Job Quotes

Value Added Tax Vat In Uae Accounting Services Bookkeeping

Value Added Tax Vat In Uae Accounting Services Bookkeeping

The Impact Of Insurance Premium Taxation Springerlink

The Impact Of Insurance Premium Taxation Springerlink

راهنمای ثبت نام آزمون ورودی مشاوران مالیاتی 99 Capital Gains Tax Tax Deductions Income Tax Return

راهنمای ثبت نام آزمون ورودی مشاوران مالیاتی 99 Capital Gains Tax Tax Deductions Income Tax Return

What Is Cost Of Goods Sold Cost Of Goods Sold Cost Of Goods Small Business Tax

What Is Cost Of Goods Sold Cost Of Goods Sold Cost Of Goods Small Business Tax

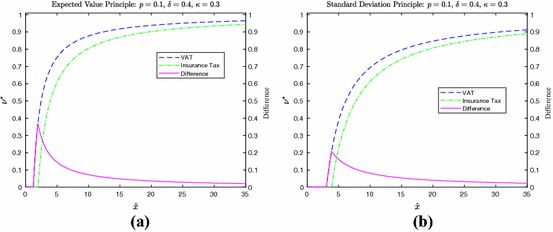

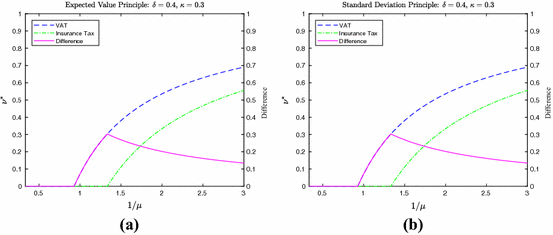

The Impact Of Insurance Premium Taxation Springerlink

The Impact Of Insurance Premium Taxation Springerlink

Gst Credit Card Bill Insurance Premium To Get Costlier Cards Credit Card Insurance Premium

Gst Credit Card Bill Insurance Premium To Get Costlier Cards Credit Card Insurance Premium

Pin By Phat Groove E Blast On Insurance Insurance Industry Insurance Premium Annuity

Pin By Phat Groove E Blast On Insurance Insurance Industry Insurance Premium Annuity

Imgur Bookkeeping Services Accounting Services Business Insurance

Imgur Bookkeeping Services Accounting Services Business Insurance

Outlookmoney Com Get Out Of This Club Fast Personal Finance Finance Insurance

Outlookmoney Com Get Out Of This Club Fast Personal Finance Finance Insurance

Tax Returns For Companies Tax Return In Kew Pnd Accountants Melbourne Tax Return Tax Time Accounting

Tax Returns For Companies Tax Return In Kew Pnd Accountants Melbourne Tax Return Tax Time Accounting

Wevola Group Hotel Branding By Jekin Gala Web Design Inspiration Infographic Inspiration Hotel Branding

Wevola Group Hotel Branding By Jekin Gala Web Design Inspiration Infographic Inspiration Hotel Branding

Value Added Tax Vat Finance Taxation Accounting Concept Vat Word Handwritten On Aff Finance Taxation Vat Added Finance Value Added Tax Accounting

Value Added Tax Vat Finance Taxation Accounting Concept Vat Word Handwritten On Aff Finance Taxation Vat Added Finance Value Added Tax Accounting

Skidka 7 Procentov Na Vse Tovary Aliekspress Epn Keshbek Instrukciya Bonus Youtube Vse

Skidka 7 Procentov Na Vse Tovary Aliekspress Epn Keshbek Instrukciya Bonus Youtube Vse

Invoice Template Design In Abstract Style Free Vector Invoice Design Template Letterhead Template Invoice Template

Invoice Template Design In Abstract Style Free Vector Invoice Design Template Letterhead Template Invoice Template

Income Tax Section 80d Deduction In Respect Of Health Insurance Premium Accounting Taxation Insurance Premium Income Tax Deduction

Income Tax Section 80d Deduction In Respect Of Health Insurance Premium Accounting Taxation Insurance Premium Income Tax Deduction

The Impact Of Insurance Premium Taxation Springerlink

The Impact Of Insurance Premium Taxation Springerlink

Mercuryadjustment Is The Best Place For The Private Claim Adjuster And The Insurance Adjuster If You Are S Bookkeeping Services Accounting Services Accounting

Mercuryadjustment Is The Best Place For The Private Claim Adjuster And The Insurance Adjuster If You Are S Bookkeeping Services Accounting Services Accounting

Income Tax Slab Rates In India For A Y 2019 20 F Y 2018 19 For Individual Income Tax Income Tax

Income Tax Slab Rates In India For A Y 2019 20 F Y 2018 19 For Individual Income Tax Income Tax

Post a Comment for "Insurance Premium Tax Vat"