Insurance Claim Received In Cash Flow Statement

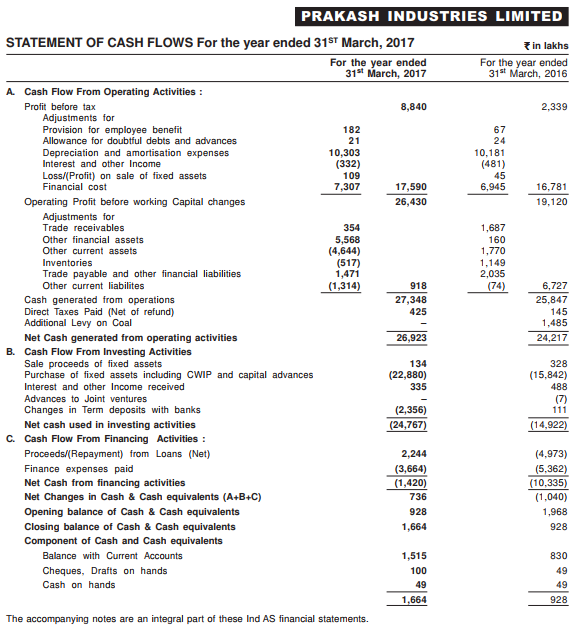

Proceeds from Sale of Real Estate Total duration. Depreciation 270793 263188 LossProfit on sale of Assets Net -1376 1485 LossProfit on Investments 37734 15042.

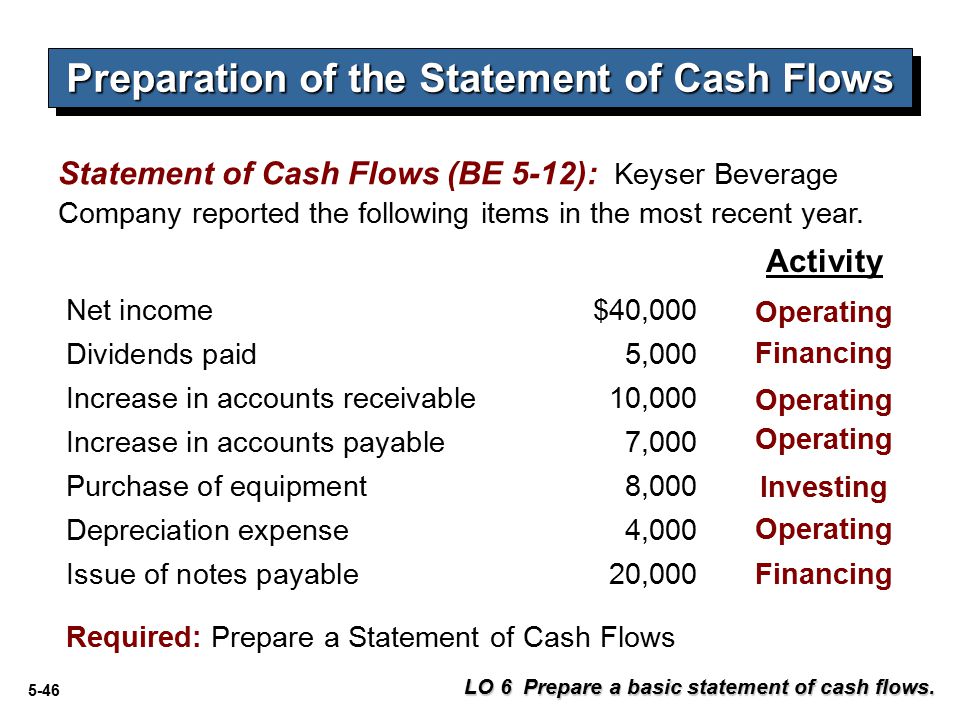

Online Account Reading What Is Cash Flow Statement Importance Of Cash Flow Statement Cash Flow Statement Under Direct Method Cash Flow Statement Under Indirect Method

Online Account Reading What Is Cash Flow Statement Importance Of Cash Flow Statement Cash Flow Statement Under Direct Method Cash Flow Statement Under Indirect Method

In general it seems that assets should be written off at a loss and the cost of replacement assets written up as a gain.

Insurance claim received in cash flow statement. Others treat interest received as investing cash flow and interest paid as a financing cash flow. The money received from an insurance company for a claim involving a loss on inventory stock is debited to Cash. In addition the Inventory account is credited for the carrying cost of the inventory items which is usually the original cost of the items.

Winnings from law suit etc. Insurance Claims Cash proceeds received from the settlement of insurance claims should be classified on the basis of the related insurance coverage that is the nature of the loss. In each case the accounting for insurance proceeds journal entries show the debit and credit account together with a brief narrative.

If balance sheets of two period are compared side by side and there is a difference in the values of its non-current assets then it means that there has been an investing activity with-in the period. Increase in creditors Rs13000 decrease in debtors Rs17000. If balance sheets of two period are compared side by side and there is a difference in the values of its non-current assets then it means that there has been an investing activity with-in the period.

Cash Flow Statement annexed to the Balance Sheet for the year ended 31st March 2008 Rs. When the claim is agreed set up an accounts receivable due from the insurance company. Cash received as compensation for an insured loss for damaged PPE property plant.

Cash proceeds received would be classified on the basis of the related insurance coverage ie the nature of the loss. Equipment Nature of transaction - Cash inflows are received to cover for losses and damages of PPE. Proceeds from loans or insurance claim payouts a positive cash flow activity.

912019 Under IFRS there are two allowable ways of presenting interest expense in the cash flow statement. Proceeds from Sale of Securities Operating Activities. Opening cash balance Rs15000 closing cash balance Rs19000.

Any other proceeds from disposing of the inventory items will also be debited to Cash. In Crore 2007-08 2006-07 A Cash Flow from Operating Activities 1 Profit Before Tax 1008040 1048500 2 Adjustments for. Receive the cash from the insurance company.

Fixed assets purchased Rs30000. This transaction represents in substance a disposal of PPE and would be classified as an investing activity. Reimbursed expenses would be a wash.

B Prepare cash flow statement from following information. 10242019 Write off the damaged inventory to the impairment of inventory account. Insurance claim received against loss of fixed assets is extraordinary investing cash inflow.

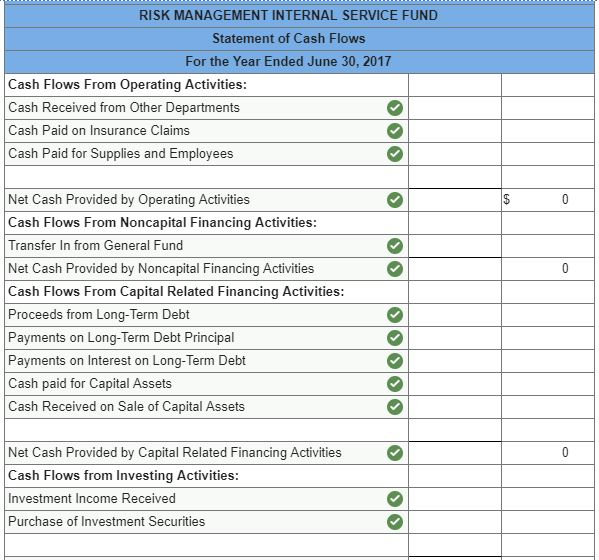

Treatment of tax Cash flow for tax payments refund should be classified as cash flow from operating activities. Cash received for the sale of real estate that is not part of an investing activity during the current period. These cash flows may comprise commissions paid for new contracts issued that insurers expect policyholders to renew in the future sometimes more than once.

Cash received as payments for insurance premiums during the current period. Insurance claim received against loss of stock or profits is extraordinary operating cash inflow. The method used is the choice of the finance director.

For some purposes it is necessary to convert the cash flows into present value figures but if this is to be done in a consistent way both income and outgo. Any cash flow relating to extraordinary items should be as far as possible be classified into operating investing or financing activities and those items should be separately disclosed in the cash flow statement. For insurance proceeds that are received in a lump-sum settlement an entity should determine the classification on the basis of the nature of each loss.

362014 Cash received related to the sale of investments which are held for trading Cash paid or received by a financial institute for the grant and receipt of loan amount Cash received or paid by the insurance company in respect of for premiums and claims Cash paid to suppliers for purchase of goods or services. 32 Fundamentally the need is to compare cash flows into and out of the insurance company. Business interruptionloss of income would be a gain.

1192010 a Calculate cash flow from operating activities. Proceeds from loans or insurance claim payouts a positive cash flow activity. Deolghostrider added an answer on 211114 Insurance claim is an extraordinary item which has not been received from normal business operations and for its has been received it is first deducted to calculate NET PROIT before extraordinary items and tax and then again it added back to calculate cash from operating activities.

For insurance proceeds that are received in a lump-sum settlement an entity would be required to determine the classification on the basis of the nature of each loss included in the settlement. 9242018 Under IFRS 17 insurance acquisition cash flows are accounted for by including them in the cash flows expected to fulfil contracts in a group of insurance contracts. 2152011 I am looking for someone who has practical knowledge of accounting for insurace claim proceeds for a fire loss.

10242015 The following points will highlight the treatment of seven items in the cash flow statement. Many companies present both the interest received and interest paid as operating cash flows. If there is any foreign exchange gain or loss a reconciliation statement to be prepared reconciling the Cash and Cash equivalents balances as there is no inflow or outflow of cash.

Rental Property Cash Flow Real Estate Investing Rental Property Rental Property Investment Rental Property Management

Rental Property Cash Flow Real Estate Investing Rental Property Rental Property Investment Rental Property Management

School Of Stocks Cash Flow Statement

School Of Stocks Cash Flow Statement

Insurance Journal Entry For Different Types Of Insurance Small Business Accounting Accounting Small Business Accounting Software

Insurance Journal Entry For Different Types Of Insurance Small Business Accounting Accounting Small Business Accounting Software

Cash Flow Statement Indirect Method Template Components Example

Cash Flow Statement Indirect Method Template Components Example

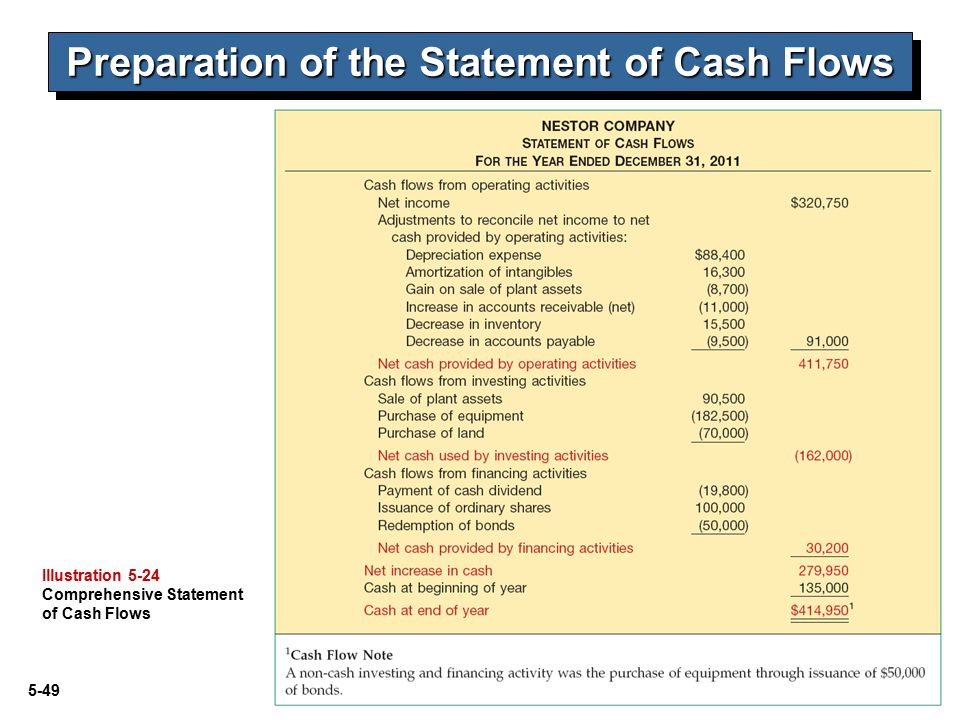

Statement Of Financial Position And Statement Of Cash Flows Ppt Download

Statement Of Financial Position And Statement Of Cash Flows Ppt Download

Accountancy Class 12 Project Cash Flow Statement Class Class Projects

Accountancy Class 12 Project Cash Flow Statement Class Class Projects

Simple Personal Financial Statement Cash Flow Statement Personal Financial Statement Statement Template

Simple Personal Financial Statement Cash Flow Statement Personal Financial Statement Statement Template

Multi Step Income Statement Income Statement Statement Template Budget Template Excel Free

Multi Step Income Statement Income Statement Statement Template Budget Template Excel Free

Cash Flow Statement Cbse Notes For Class 12 Accountancy Cbsenotesclass 12accountancy Cashflowstatement Cash Flow Statement Cash Flow Cash Management

Cash Flow Statement Cbse Notes For Class 12 Accountancy Cbsenotesclass 12accountancy Cashflowstatement Cash Flow Statement Cash Flow Cash Management

Profit Loss Statement Example Best Of Profit And Loss Template Strong Illustration Templates Profit And Loss Statement Income Statement Statement Template

Profit Loss Statement Example Best Of Profit And Loss Template Strong Illustration Templates Profit And Loss Statement Income Statement Statement Template

Cash Flow Statement Template Excel Cash Budget Template Cash Budget Template Will Be Related To Maintaining Three Cash Flow Statement Cash Budget Cash Flow

Cash Flow Statement Template Excel Cash Budget Template Cash Budget Template Will Be Related To Maintaining Three Cash Flow Statement Cash Budget Cash Flow

So Easy To Calculate The Intrinsic Value Of The Company Cash Flow Statement Intrinsic Value Financial Modeling

So Easy To Calculate The Intrinsic Value Of The Company Cash Flow Statement Intrinsic Value Financial Modeling

Us Bank Statement Template Beautiful Usbank Statement Template Credit Card Statement Bank Statement

Us Bank Statement Template Beautiful Usbank Statement Template Credit Card Statement Bank Statement

What Is Fcra Registration In 2020 Best Workplace Registration Cash Flow Statement

What Is Fcra Registration In 2020 Best Workplace Registration Cash Flow Statement

Solved The Following Is A Statement Of Cash Flows For The Chegg Com

Solved The Following Is A Statement Of Cash Flows For The Chegg Com

Statement Of Financial Position And Statement Of Cash Flows Ppt Download

Statement Of Financial Position And Statement Of Cash Flows Ppt Download

Statement Of Financial Position And Statement Of Cash Flows Ppt Download

Statement Of Financial Position And Statement Of Cash Flows Ppt Download

Financial Statements Of General Insurance Companies Ppt Video Online Download

Financial Statements Of General Insurance Companies Ppt Video Online Download

Post a Comment for "Insurance Claim Received In Cash Flow Statement"