Zurich Insurance Expense Ratio

Zurich Insurance Cos Earnings per Share Diluted for the trailing twelve months TTM ended in Dec. Zurich has today published its Financial Condition Report 2019 which highlights once more the Groups financial strength.

Chapter Iii The Financial Market Activities Of Insurance And Reinsurance Companies Global Financial Stability Report June 2002 Market Developments And Issues

Chapter Iii The Financial Market Activities Of Insurance And Reinsurance Companies Global Financial Stability Report June 2002 Market Developments And Issues

Therefore Zurich Insurance Group AGs PE Ratio for today is 1644.

Zurich insurance expense ratio. Zurich Insurance Group annual research and development expenses for 2018 were 0B a NAN decline from 2017. ZURVY Loss Ratio data is not available for the most recently reported fiscal quarter ending 2020-06-30. The lowest was 727.

Therefore Zurich Insurance Cos PE ratio for today is. There is no material difference between how risk and capital are managed at the Zurich Insurance Group and ZRe. 9192018 Overall North American CAT losses drove up the groups 2017 combined ratio to 1004 under AM.

Zurich Insurance Group AGs dividend payout ratio for the months ended in Jun. As of January 1 2020 Zurichs Swiss Solvency Test ratio stood at 198 7 compared with 221 one year earlier. 9262019 Zurich groups balance sheet strength is underpinned by risk-adjusted capitalisation as measured by Bests Capital Adequacy Ratio BCAR being at the strongest level.

Well positioned to deliver on 2017 to 2019 financial targets with approximately USD 900 million in cost savings achieved a BOPAT ROE of 123 an estimated Zurich Economic Capital Model Z-ECM ratio of 134 1 and cash remittance levels on track to. Estimated Zurich Economic Capital Model ratio at a very strong 129 2 and above the 100-120 target range Zurich Insurance Group Zurich today reported a 16 increase in 2019 business operating profit and proposed raising the dividend to CHF 20 per share as the company benefits from an improved business mix reduced volatility and enhanced profitability. 282019 Zurichs combined ratio in 2018 was 978 percent compared to 1009 percent during 2017.

Zurich Insurance Cos EPS Diluted for the six months ended in Dec. Zurich Insurance Group annual research and development expenses for 2017 were 0B a NAN decline from 2016. Zurich pays 99 of UK claims in 2018.

During the past 13 years Zurich Insurance Group AGs highest PE Ratio was 2187. 472018 There are two components to the combined ratio - the loss ratio and the expense ratio - and Zurich has had challenges with both. Our expense ratio in simple terms is the cost of running our business as a percentage of our premium income.

The dividend payout ratio of Zurich Insurance Group AG is 095 which seems too high. Zurich Insurance Group annual research and development expenses for 2019 were 0B a NAN decline from 2018. As of March 31 2020 the Z-ECM ratio is estimated at 101 2 and remains within the Groups targeted range.

When a combined ratio is over 100 percent the company loses money on its underwriting. If a company dividend payout ratio is too high its dividend may not be sustainable. The expense ratio increased by 07 percentage points mainly as a result of lower premium volumes despite reduced costs and the effect of positive non-recurring items in 2016.

7242020 The expense ratio in the insurance industry is a measure of profitability calculated by dividing the expenses associated with acquiring underwriting and. The net underwriting result improved by USD 14 billion to USD 412 million with an overall combined ratio of 984 percent an improvement of 51 percentage points from 2015. As of today 2020-12-13 Zurich Insurance Cos share price is ZAR230000000.

The loss ratio is calculated by taking the incurred underwriting losses and then dividing them by earned premium. The principles of the Zurich Insurance Groups enterprise risk management described in the Corporate governance and risk management section and in the Risk profile section are applicable to ZRe. 2122021 Zurich Insurance Group AG OTCQXZURVY Q4 2020 Earnings Conference Call February 11 2021 700 AM ET Company Participants Richard Burden - Head of Investor Relations and Rating Agency Management.

And the median was 1200. Underwriting Losses Total Net Premiums Earned. Included are employee salaries and benefits the cost of running our offices commissions to brokers and travel costs.

Zurich Insurance Group AGs EPS Diluted for. Zurich Insurance Group Ltd. However Zurichs comprehensive and recently realigned reinsurance program.

Switzerland Switzerland Financial Sector Assessment Program Technical Note Insurance Regulation And Supervision

Switzerland Switzerland Financial Sector Assessment Program Technical Note Insurance Regulation And Supervision

Switzerland Switzerland Financial Sector Assessment Program Technical Note Insurance Regulation And Supervision

Switzerland Switzerland Financial Sector Assessment Program Technical Note Insurance Regulation And Supervision

Performance View Zurich Insurance

Performance View Zurich Insurance

Performance View Zurich Insurance

Performance View Zurich Insurance

Health Insurance Icons Health Insurance Best Health Insurance Health Insurance Humor

Health Insurance Icons Health Insurance Best Health Insurance Health Insurance Humor

Https Www Zurich Com New Joiner Media 969fae61e59d415cbbe39799c9459f65 Ashx

Market Risk Including Investment Credit Risk Zurich Annual Report 2016

Market Risk Including Investment Credit Risk Zurich Annual Report 2016

Have You Ever Heard Someone Say In Relation To A Problem We Were Encountering There Is No Car Insurance Rates Life Insurance Policy Life Insurance Companies

Have You Ever Heard Someone Say In Relation To A Problem We Were Encountering There Is No Car Insurance Rates Life Insurance Policy Life Insurance Companies

Performance View Zurich Insurance

Performance View Zurich Insurance

Insurance Company Insurance Company Ratio Analysis

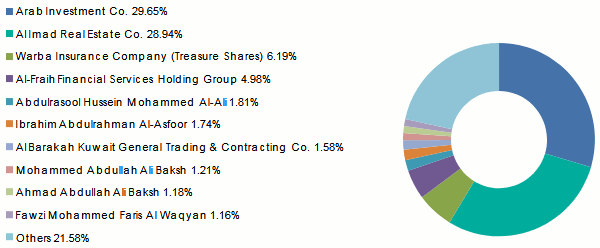

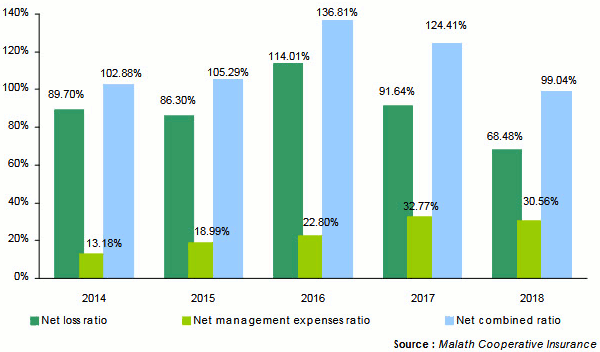

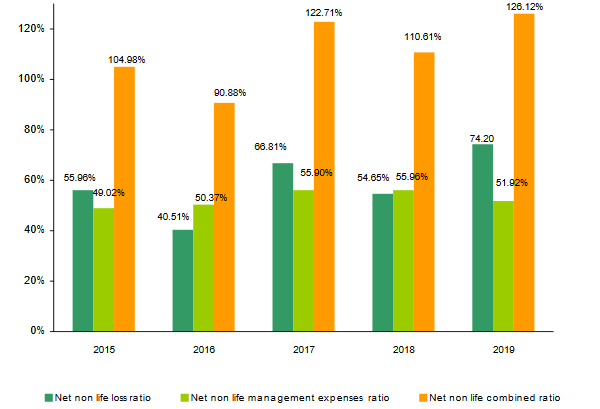

Warba Insurance Turnover And Technical Highlights 2018

Warba Insurance Turnover And Technical Highlights 2018

Household Spending On Insurance 2000 2019 Statista

Household Spending On Insurance 2000 2019 Statista

Switzerland Switzerland Detailed Assessment Of Observance Insurance Core Principles

Switzerland Switzerland Detailed Assessment Of Observance Insurance Core Principles

Htf Mi Analyst Have Added A New Research Study On Title Global Digital Innovation In Insurance Market Size Innovation Management Swot Analysis Future Trends

Htf Mi Analyst Have Added A New Research Study On Title Global Digital Innovation In Insurance Market Size Innovation Management Swot Analysis Future Trends

Post a Comment for "Zurich Insurance Expense Ratio"