P&c Insurance Hard Market

With each year underwriters are becoming more sophisticated looking more closely at losses safety records and financials. Absolute growth in global PC premiums has increased from previous years largely because of the robust expansion of the US PC market which contributed approximately 40 percent of the premium growth for the 201617 period.

Twitter Life Insurance Types Universal Life Insurance Term Life

Twitter Life Insurance Types Universal Life Insurance Term Life

The company said the intense hard directors and officers market is worsening.

P&c insurance hard market. The property and casualty PC sector is building on a strong 2018 in which the industry saw a net income increase of 66 to USD 60 billion also 108 boost in the net premiums written and nearly breaking even on underwriting after losing USD 233 billion the year before. During a hard market underwriting gets tougher and more stringent. Accident and motor insurance posed the largest increase in the United States during this period mainly resulting.

11102020 Considering this list of disasters the primary issue impacting the PC insurance market is uncertainty. 1132021 The PC Insurance Industry has experienced 18-24 months of a hard market with some indicators of an upward trend going into 2021. Wilcox notes the insurance market continued to harden while capacity remained tight but not scare as carriers deployed resources more.

10212020 The state of the PC insurance marketplace COVID-19 and other trends have accelerated changes in an already rapidly evolving insurance market. 5222020 22nd May 2020 - Author. As a whole property and casualty PC insurance represents 16 trillion in premiums about one-third of the insurance industry and remains one of the few industries that has yet to be disrupted.

Typically companies would underprice or excessively relax. In this type of market insurance is generally more difficult for buyers to obtain. In 2018 private PC insurers wrote CAD 132 billion in direct written premiums for personal property insurance and paid out CAD 78 billion for direct claims incurred.

When the growth in demand for insurance increases more rapidly than the available supply of insurance the outcome is a hard insurance market. 2192020 The hard market is just one of many reasons insurance rates are going up across the country. A hard market is a phase of the property and casualty insurance cycle that is characterized by high demand and low supply.

Insurers have been working the last two years to address profitability problems that arose from a combination of inadequate pricing and increasing losses. 1272020 State of the PC insurance market in Q3 2020 Burns. Resilience relevance and reinvention.

After several years of falling rates in what is typically described as a soft market rates in property. Is a 2 decrease to a 2 increase for workers compensation and a possible increase of 40 or more for umbrella insurance. By Kimberly George and Mark Walls October 21 2020.

The propertycasualty PC insurance industry cycle is characterized by periods of soft market conditions in which premium rates are stable or falling and insurance is readily available and by periods of hard market conditions where rates rise coverage may be more difficult to find and insurers profits increase. 5292018 In the old days only about 10 years ago the PC industry would go through hard and soft market cycles. Increased underwriting scrutiny of DO exposures and price.

What can we expect from insurance carriers during a hard market. We are seeing insurance carriers dig deeper into a companys financials than in the past. Matt Sheehan While favourable pricing trends in the US property and casualty PC market have been gaining some momentum this year analysts at Fitch Ratings do not believe these increases are likely to cause a return to hard market conditions.

Casualty PC are now starting to harden for both US. PC pricing momentum unlikely to result in hard market says Fitch 14th November 2019 - Author. Scope of the Report This report aims to provide a detailed analysis of the property and casualty insurance market in.

There are a few ways a hard market could affect you as an insurance customer whether youre shopping for a new policy trying to renew your existing policy or making updates to your existing coverage. PC hard market to extend through 2021 due to pandemic Willis Towers Watson. International risks and are likely to continue going up as carriers reduce their capacity especially at Lloyds of London in a profitability push following two years of severe losses.

As insurers exit the hard market and shift into a soft market there are key opportunities to leverage and stay a step ahead of competition. Steve Evans Market forces suggest that 2021 could see the hardest property and casualty PC insurance and reinsurance market conditions for a.

Covid 19 To Test Us P C Insurance Industry S Resilience In 2020 And Beyond S P Global Market Intelligence

Covid 19 To Test Us P C Insurance Industry S Resilience In 2020 And Beyond S P Global Market Intelligence

The Internet Of Things Opportunity For Insurers Article Netherlands Kearney

The Internet Of Things Opportunity For Insurers Article Netherlands Kearney

P C Insurers Must Transform Their Workforces If They Want To Benefit From The Rise In Platform Businesses Accenture Insurance Blog

P C Insurers Must Transform Their Workforces If They Want To Benefit From The Rise In Platform Businesses Accenture Insurance Blog

China S P C Sector Continues To Be Dominated By Large Companies S P Global Market Intelligence

China S P C Sector Continues To Be Dominated By Large Companies S P Global Market Intelligence

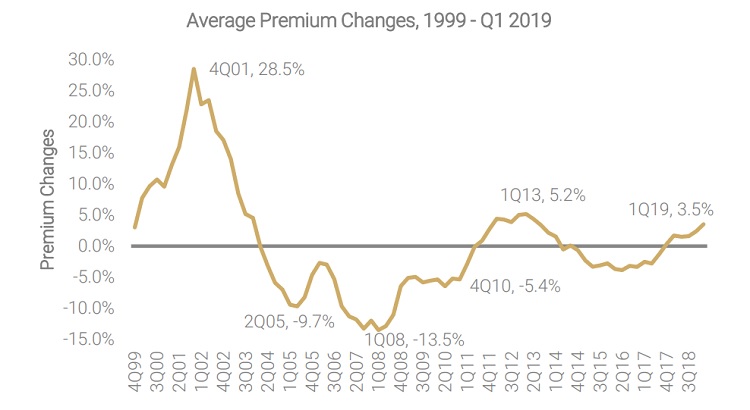

Ciab Reports Further Increases For Commercial P C Premium Prices In Q1 Reinsurance News

Ciab Reports Further Increases For Commercial P C Premium Prices In Q1 Reinsurance News

Chart Historical Capital Levels Of Guy Carpenter Global Reinsurance Composite

Chart Historical Capital Levels Of Guy Carpenter Global Reinsurance Composite

P C Insurance Industry Remade Scenarios For Leaders Deloitte Financial Services

P C Insurance Industry Remade Scenarios For Leaders Deloitte Financial Services

State Of The P C Insurance Market In Q3 2020 Propertycasualty360

State Of The P C Insurance Market In Q3 2020 Propertycasualty360

P C Rates Up 9 6 Amid Pandemic Ciab Reinsurance News

P C Rates Up 9 6 Amid Pandemic Ciab Reinsurance News

The Impact Of Covid 19 On The Insurance Market Wedgwood Insurance

The Impact Of Covid 19 On The Insurance Market Wedgwood Insurance

Disruption In P C Insurance Distribution Aite Group

How To Reduce Insurance Claims Leakage And The Loss Ratio Via Standardization Business Intelligence And Robotic Process Automation Rpa The Lab Consulting

Hospital Losses Lessons For The Insurance Industry Advisen Blog Insurance Industry Hospital Loss

Hospital Losses Lessons For The Insurance Industry Advisen Blog Insurance Industry Hospital Loss

The State Of The P C Insurance Marketplace Post Covid 19 Johnson Kendall Johnson

The State Of The P C Insurance Marketplace Post Covid 19 Johnson Kendall Johnson

Net Premiums Written For P C Insurance Canada 2019 Statista

Net Premiums Written For P C Insurance Canada 2019 Statista

Post a Comment for "P&c Insurance Hard Market"