Insurance Reimbursement Accounting Treatment

Reimbursement of business expenses. The cost less depreciation equals book value.

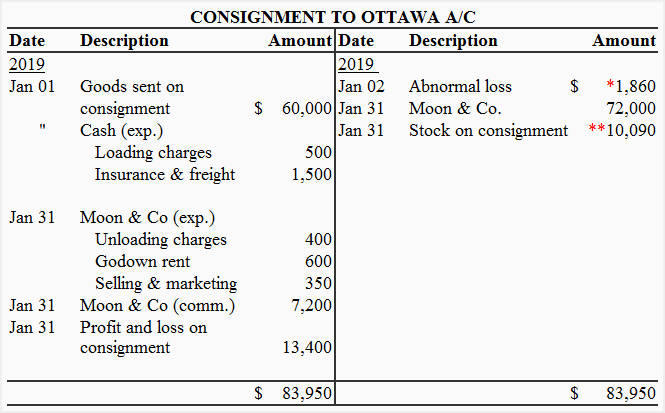

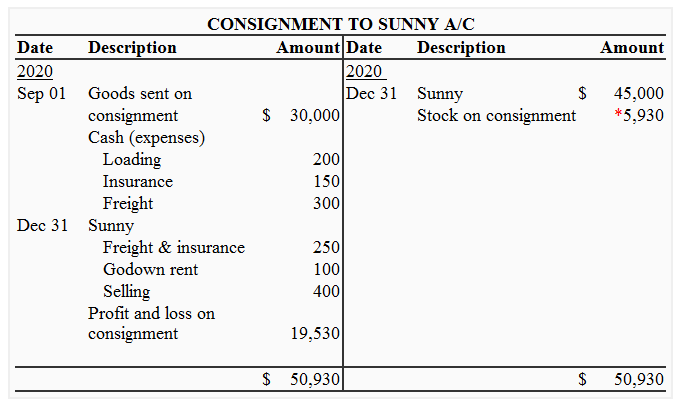

Normal And Abnormal Loss In Consignment Definition Explanation Treatment Example Accounting For Management

Normal And Abnormal Loss In Consignment Definition Explanation Treatment Example Accounting For Management

Accounting Accounting Solutions journal entry.

Insurance reimbursement accounting treatment. Here we are looking at an insurance company that receives the payment. 12172020 Accounting for insurance proceeds December 17 2020 When a business suffers a loss that is covered by an insurance policy it recognizes a gain in the amount of the insurance proceeds received. 2152011 Your insurance company cash advances andor reimbursements will following along the same lines.

Advance from Employee Account Cr 2. C Set up General Ledger accounts to capture all of these types of spending and reimbursement related to these two types of losses. The calculation of compensation can be quite subjective involving the roll-forward of historical performance into the period of loss.

When the insurance premiums are paid in advance they are referred to as prepaid. Tax Treatment of Insurance Policy Premium Insurance premiums are tax deductible if they are expenses incurred wholly and exclusively in the production of income. And assist with claim filing and claim audits.

This Guideline sets out the recommended accounting for general insurance business including reinsurance. An asset relating to an insurance recovery should be recognized only when realization of the claim is deemed probable and only to the extent of the related loss recognized in the financial statements. The critical terms of an insurance policy such as which types of losses are covered policy deductibles.

Debit Loss on Insurance Settlement. When employee pays the tuition fee. Write off the damaged inventory to the impairment of inventory account.

Because of the nature of general insurance business the period of insurance cover usually extends into different accounting periods. It should be an offset to insurance expense. Sometimes the insurance company will pay you less than the amount you paid.

7112019 Example of Accounting Treatment. If this is the case record the entries as. Accounting treatment for lost or stolen tangible fixed assets such as motor vehicles is similar to the accounting for disposal of such assets without any sale proceeds.

Any asset subject to an insurance claim should be transferred to a Disposal Account. Tuition Fees Expenses account Dr. Therefore the primary issue in accounting for general insurance policies is the recognition of revenue and.

When the claim is agreed set up an accounts receivable due from the insurance company. Insurance arrangements might cover varying degrees of property damage lost profits often referred to as business interruption or BI and other liabilities and expenses such as environmental remediation cleanup or repairs. Receive as debit to cash credit to the same insurance expense account to which payment is normally made.

472017 Insurance Premium Income This first accounting treatment is applicable to a business owner who is risk-averse. The process is split into three stages as follows. The most reasonable approach to recording these proceeds is to wait until they have been received by the company.

Take the example shared above DR your bank account and CR Insurance Premium account with the 100000 received from a customer. It will ease your analytical pain. Dr Insurance receivable debtor 4500 5000-500 Cr Insurance income 4500 So you have insurance income of 4500 credit versus the repair cost expense of 5000 which means your business lost 500 on this whole thing.

When employer reimburses to employee for his paid tuition fees. Recoveries of revenue are not considered incurred losses but accounted for as gain contingencies. This usually happens when net book value of the property book value minus accumulated depreciation is more than the amount reimbursed.

The method used to account for insurance claims is the disposal method. 8222019 As long as the insurance claim remains open management should continue to evaluate its estimates for each subsequent accounting period. If this is a refund or reimbursement it is NOT other income.

Hope that makes sense. 10242019 The journal entries below act as a quick reference for accounting for insurance proceeds. 2162021 Reimbursement is compensation paid by an organization for out-of-pocket expenses incurred or overpayment made by an employee customer or another party.

Advance from Employee Account Dr. And then for the insurance reimbursement record this separately. 572020 A potential insurance recovery should be evaluated and accounted for separately from the related loss and should not in any way affect the recorded amount of the loss.

For example if in 2018 an entity filed an insurance claim for property damages but had not determined the amount and likelihood of collection by December 31 2018 no revenue or related receivable would be recorded for 2018. At the end of any accounting period the amount of the insurance premiums that remain prepaid should be reported in the current asset account Prepaid Insurance. The organization may also have business interruption insurance that will provide coverage of lost revenue.

Insurance Proceed on damaged property. The fixed asset must be de-recognized from the statement of financial position and a loss must be recognized for the carrying amount of the lost or stolen asset. Depreciation on the asset for the relevant period is calculated and credited to the disposal account with the insurance settlement.

12242020 The amount of profit to be reimbursed by the insurer is based on the amount of lost sales or customer orders which are estimated based on historical sales information. Couple of ways to do this step depending on version and level of detail needed or required.

Normal And Abnormal Loss In Consignment Definition Explanation Treatment Example Accounting For Management

Normal And Abnormal Loss In Consignment Definition Explanation Treatment Example Accounting For Management

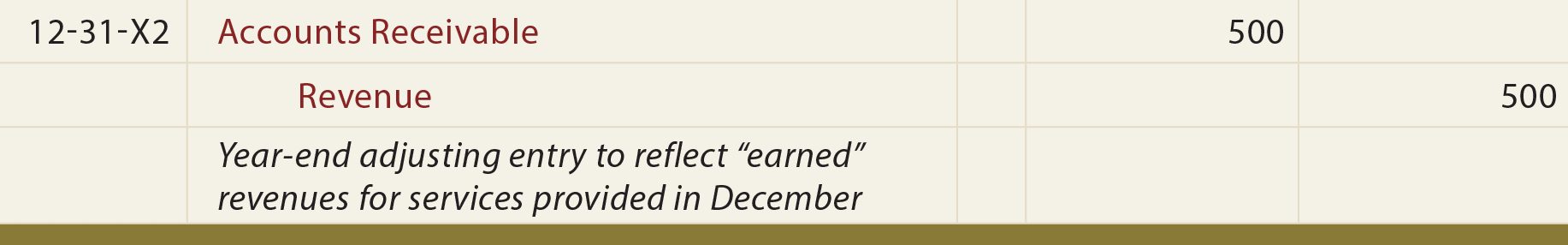

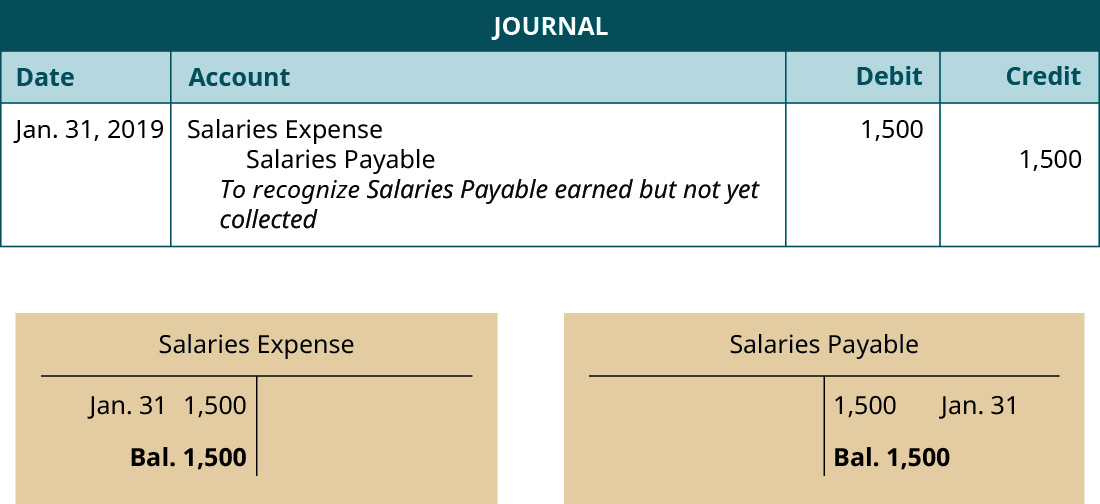

The Adjusting Process And Related Entries Principlesofaccounting Com

The Adjusting Process And Related Entries Principlesofaccounting Com

Insurance Journal Entry For Different Types Of Insurance

Insurance Journal Entry For Different Types Of Insurance

Issues In Current Return Premium Accounting

Issues In Current Return Premium Accounting

Accounting For Insurance Claim Destruction Of Asset Manager Forum

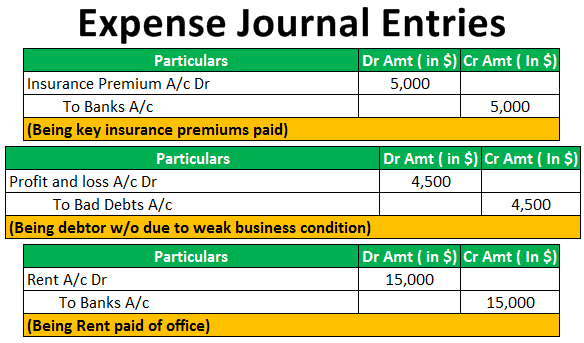

Expense Journal Entries How To Pass Journal Entries For Expenses

Expense Journal Entries How To Pass Journal Entries For Expenses

Accounting For Insurance Claim Destruction Of Asset Manager Forum

How To Account For Stolen Inventory 8 Steps With Pictures

How To Account For Stolen Inventory 8 Steps With Pictures

Insurance Journal Entry For Different Types Of Insurance

Insurance Journal Entry For Different Types Of Insurance

Insurance Journal Entry For Different Types Of Insurance

Insurance Journal Entry For Different Types Of Insurance

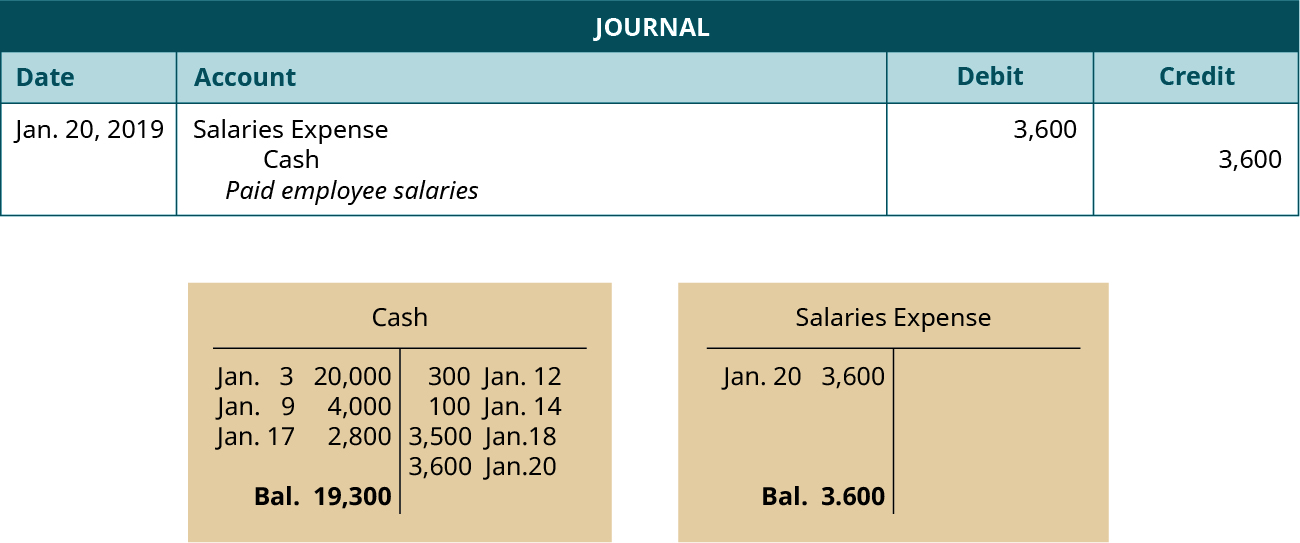

Payroll Journal Entries For Wages Accountingcoach

Payroll Journal Entries For Wages Accountingcoach

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

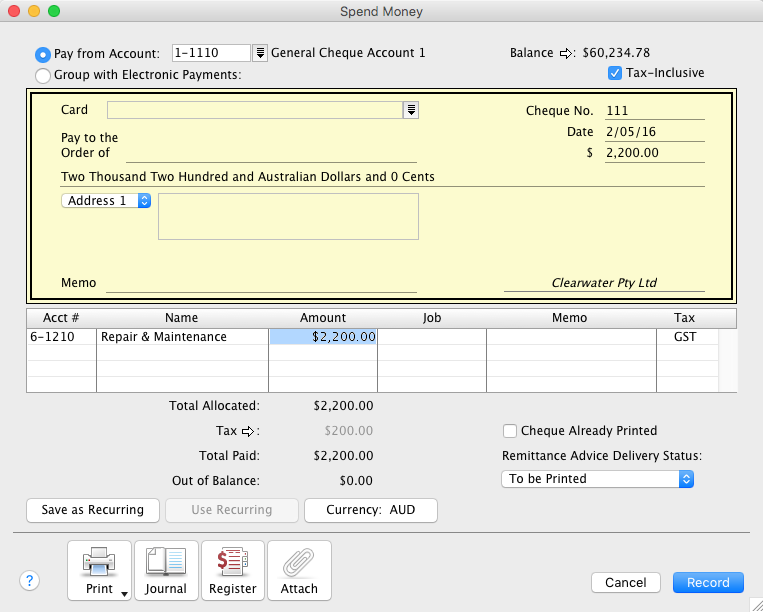

Insurance Settlements Australia Only Support Notes Myob Accountedge Myob Help Centre

Insurance Settlements Australia Only Support Notes Myob Accountedge Myob Help Centre

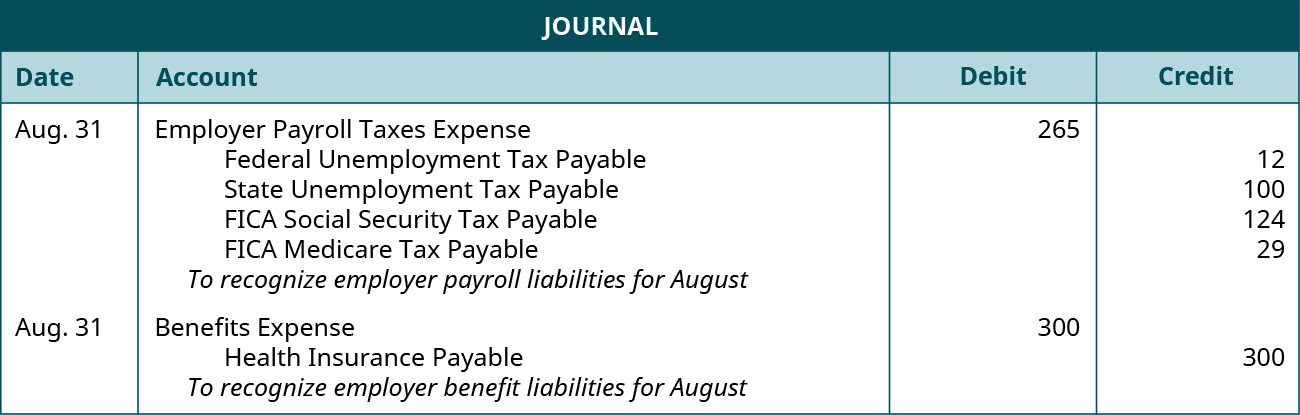

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Insurance Journal Entry For Different Types Of Insurance

Insurance Journal Entry For Different Types Of Insurance

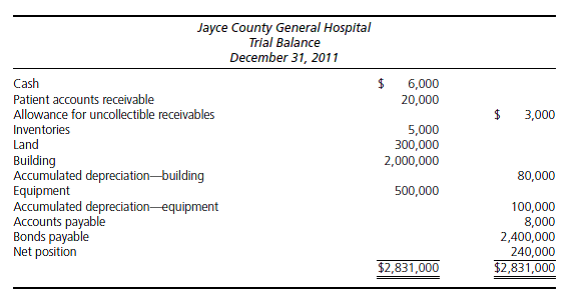

Solved Journal Entries And Financial Statements Following I Chegg Com

Solved Journal Entries And Financial Statements Following I Chegg Com

Record And Post The Common Types Of Adjusting Entries Principles Of Accounting Volume 1 Financial Accounting

Record And Post The Common Types Of Adjusting Entries Principles Of Accounting Volume 1 Financial Accounting

Insurance Claim For Loss Of Stock

Insurance Claim For Loss Of Stock

Insurance Settlements Australia Only Support Notes Myob Accountedge Myob Help Centre

Insurance Settlements Australia Only Support Notes Myob Accountedge Myob Help Centre

Post a Comment for "Insurance Reimbursement Accounting Treatment"