Insurance Rate Hardening

Workers compensation rate decreases are flattening according to WTW with a slight increase now seen in response to high severityexcess losses. 9252020 Market hardening isnt typically caused by just one event but rather a combination of factors that all place increased pressure on the insurance industry.

Hard Market Vs Soft Market The Insurance Industry S Cycle And Why We Re Currently In A Hard Market

Hard Market Vs Soft Market The Insurance Industry S Cycle And Why We Re Currently In A Hard Market

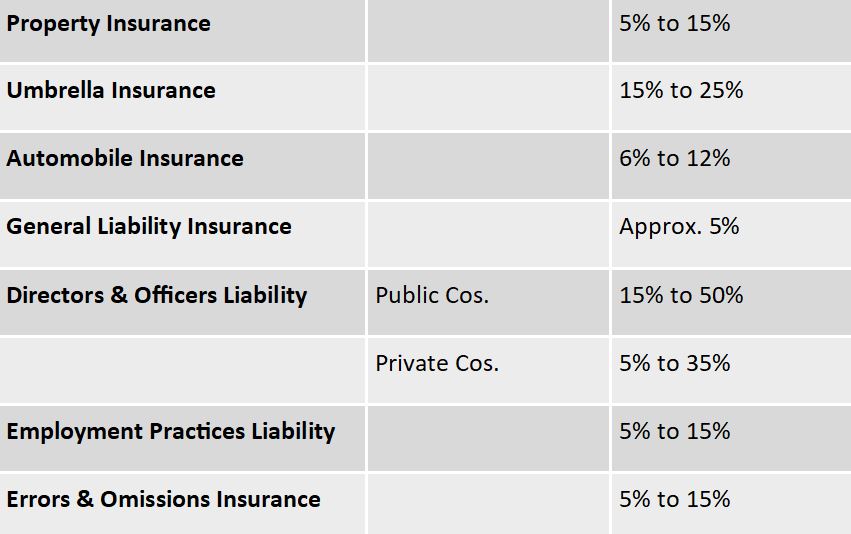

There are very few insurance coverages that have not seen rate increases in the past several months.

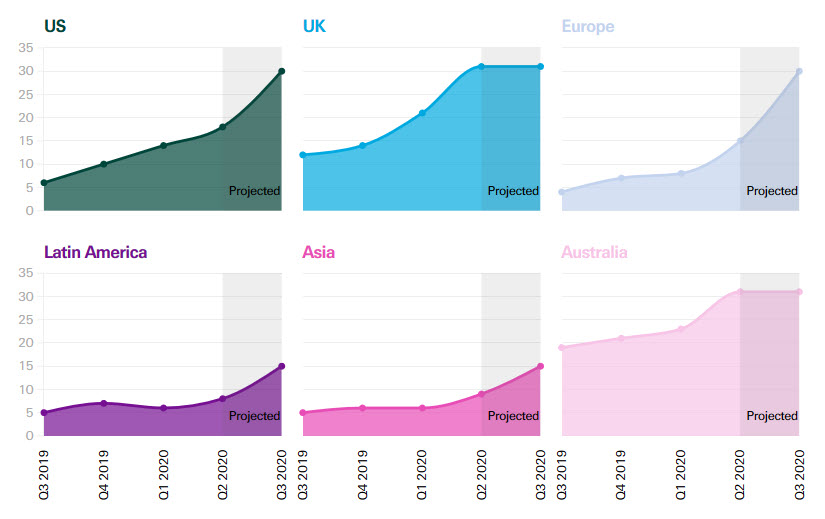

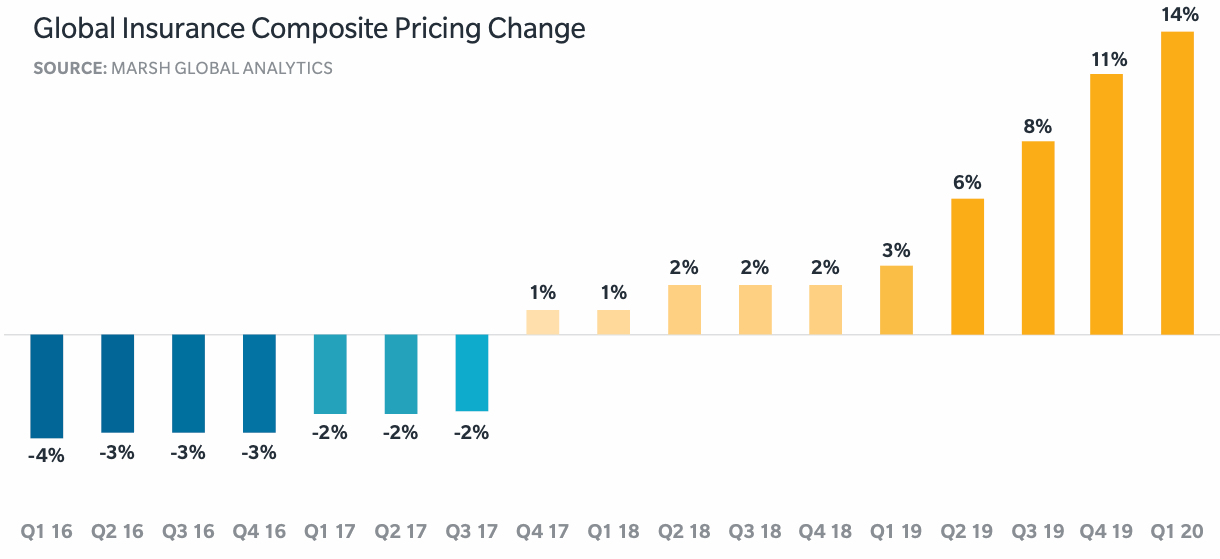

Insurance rate hardening. 1132019 After years of mostly falling or flat insurance rates we are now seeing signs of a hardening insurance market. 992020 Aons second-quarter update said rates continue to harden across the global insurance market with average rises between 11 and 30. Even before the COVID-19 worldwide pandemic there were many factors already contributing to the hardening of insurance markets.

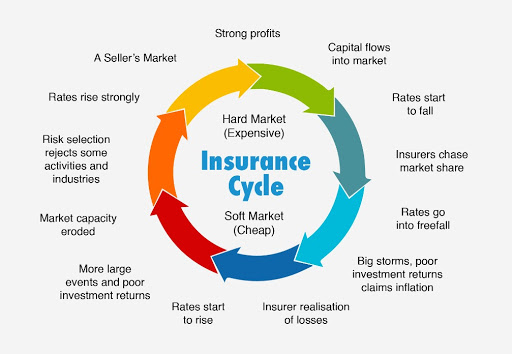

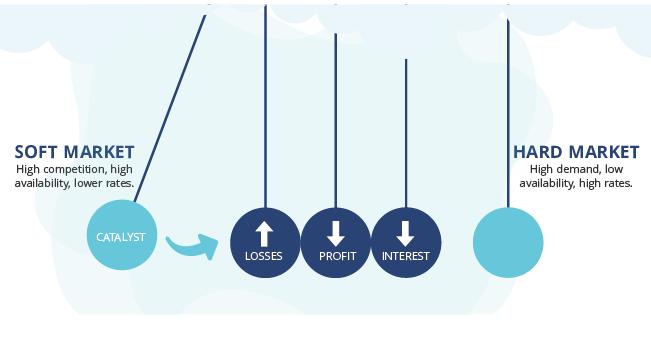

It fluctuates between the soft market when premiums hold steady or decrease and the hard market when rates increase and coverage is harder to find During the soft market a lot of insurance companies will offer lower rates to try to expand their market share. However as the insurance companies have sustained significant losses in aviation and other markets in recent years think hurricanes tsunamis floods earthquakes and fires losses have outpaced premiums. There is however often a catalyst which speeds up the process for example the 911 attacks in the early 2000s and the coronavirus pandemic today.

752020 Commercial Insurance Market Is Hardening Thu 07 May 2020 - 101 PM ET Fitch Ratings expects continued rate hardening in the commercial insurance market. The overall insurance market conditions have reverted to a state of hardening. However hardening rates and the prospect of continued pricing momentum in 2021 has also been a driving theme during discussions.

Tense reinsurance renewals point to cyber rate hardening ahead. 4292020 Hardening describes conditions of rising prices and falling volatility in a particular market. 1182021 Reinsurance hardening to hit primary coverage in 2021 By Stuart Collins on January 18 2021 The hardening reinsurance market could mean higher prices for corporate insurance buyers into 2021 and signal a period of restricted coverage and reduced underwriting flexibility.

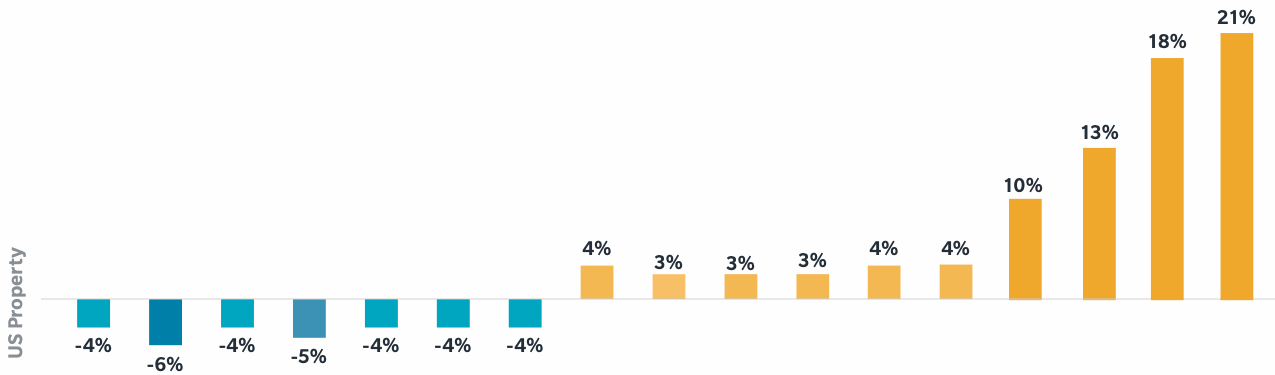

Non-life commercial insurance providers have reported double-digit price increases for a variety of lines of business across all major global regions for 2019. It warned that the gap between supply and demand in the EMEA region is increasingly working against buyers. 1232020 The change is a result of a hardening of the insurance market after more than a decade of flat to in some cases decreasing premiums.

The Hard Market Explained The market for insurance is cyclical. Underwriting standards tighten and insurers. While rates start hardening the impact and severity vary on the basis of occupancy history risk quality and profile.

In the first quarter of 2019 rates rose 2 on average according to our latest Insurance Marketplace Realities report. Some of these factors include. A range of sources in the reinsurance market said cedants needed a stark reassessment of primary rates.

1012019 A dramatic cutback in limits is leaving wholesalers scrambling to fill excess and surplus lines programs for policyholders who face higher rates in a hardening market. After years of soft market conditions in the broader PC sector the primary insurance and retro markets were already well into hard or hardening territory before Covid-19 hit. This is what the recent data is telling us about expected insurance rate increases.

12172020 The current hardening of reinsurance rates would need to continue for at least a few more years to have a meaningful impact for reinsurers many of whom are struggling to meet the cost of capital in an historically low-interest rate environment. Meanwhile general liability rates will increase 7515 percent WTW predicts. General liability insurers are seeing an increasing number of claims in areas which insurers have historically provided cover at no additional premium such as inner limits for professional indemnity and financial loss.

Hardening is most commonly applied when referring to. 1252021 A hard insurance market is the upswing in a market cycle when insurance premium rates are escalating and insurers are disinclined to negotiate terms. The Ogden Rate is used to calculate the value of compensation paid to a claimant who has suffered significant personal injuries.

142021 The insurance hardening market cycle that began more than three years ago is being exacerbated by falling investment returns from the low-interest-rate environment as well as the onslaught of risks. 1242020 Cyber-insurance rates are expected to increase 1030 percent in 2021 according to the WTW report.

Why Is The Uk Insurance Market Hardening So Much Hamilton Leigh

Why Is The Uk Insurance Market Hardening So Much Hamilton Leigh

Reinsurance Insurance Earthquakes Catastrophemodeling Hazard Analysis Earthquake Spatial

Reinsurance Insurance Earthquakes Catastrophemodeling Hazard Analysis Earthquake Spatial

U S Commercial Property Insurance Rates Rise 21 In Q1 2020 Artemis Bm

U S Commercial Property Insurance Rates Rise 21 In Q1 2020 Artemis Bm

Market Conditions Cycles And Costs Iii

Market Conditions Cycles And Costs Iii

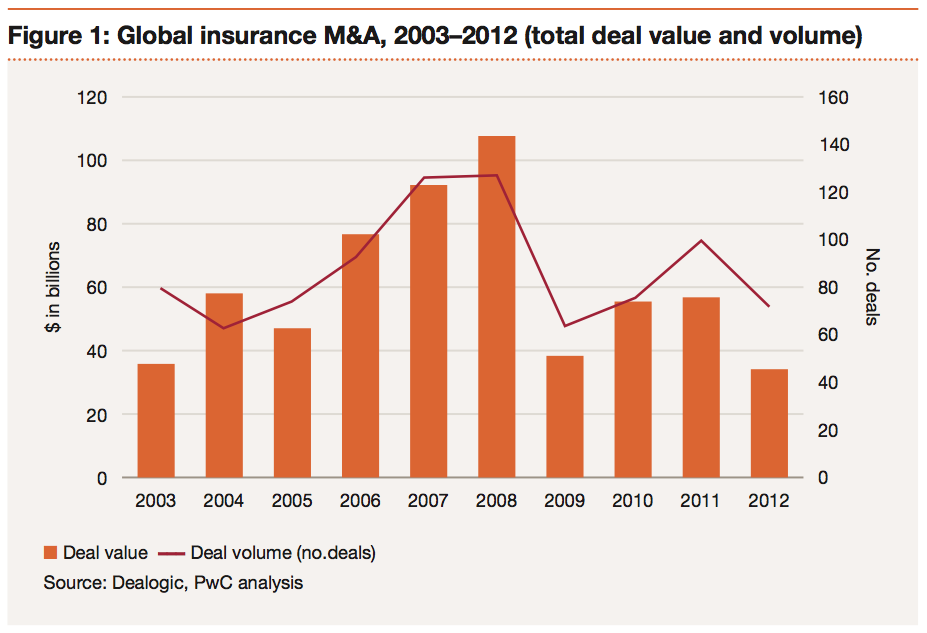

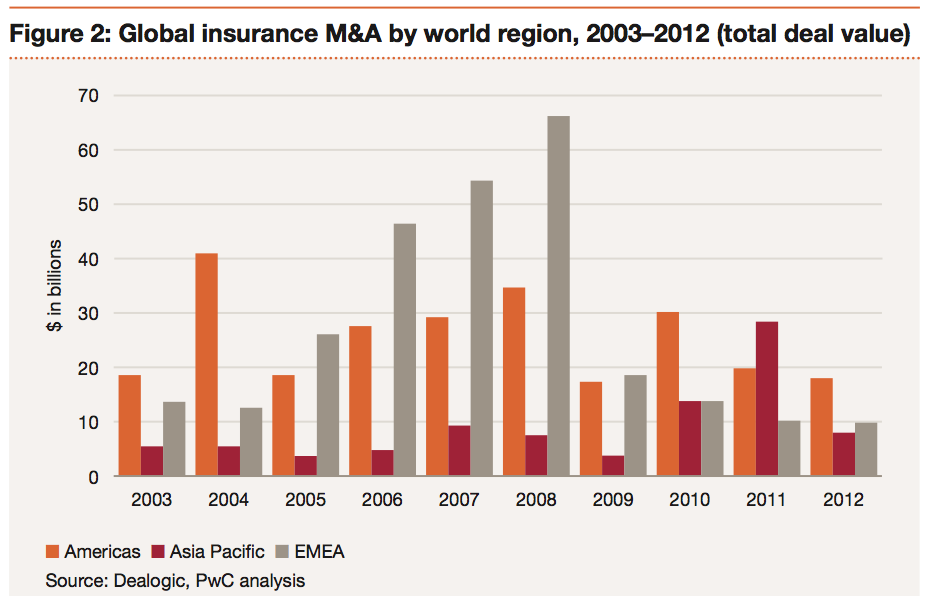

Insurance 2020 A Quiet Revolution The Future Of Insurance M A Institute For Mergers Acquisitions And Alliances Imaa

Insurance 2020 A Quiet Revolution The Future Of Insurance M A Institute For Mergers Acquisitions And Alliances Imaa

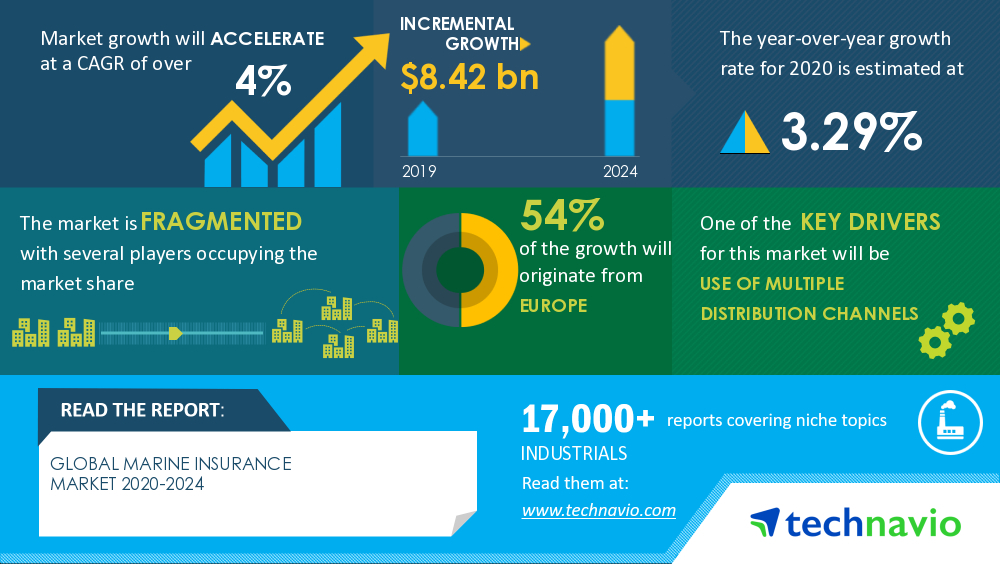

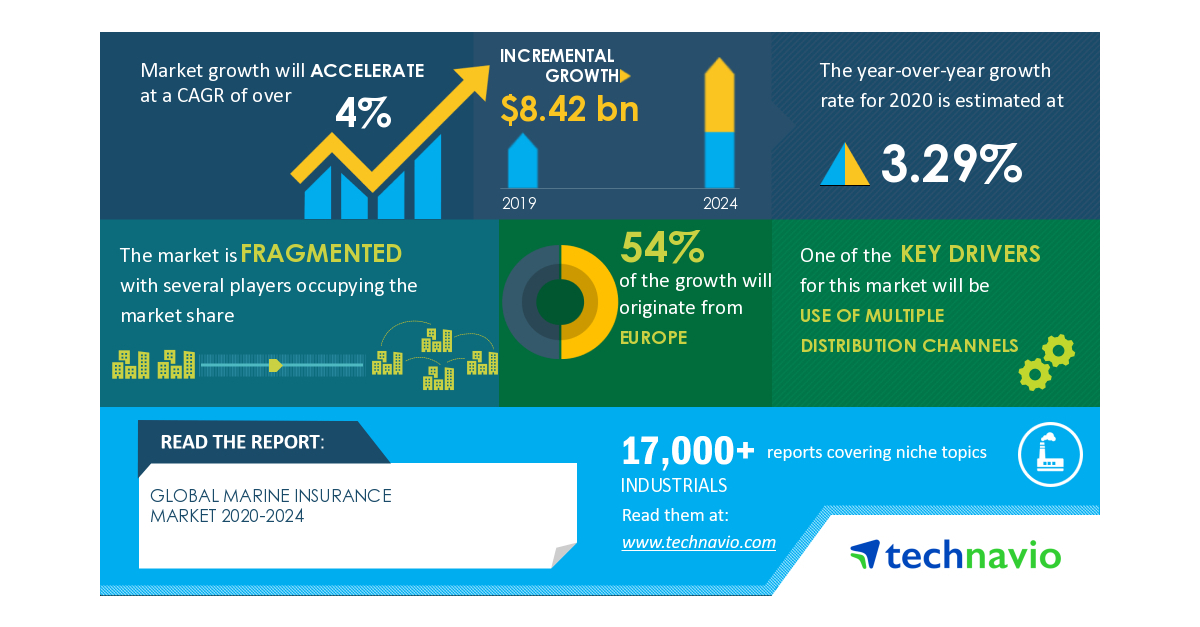

Global Marine Insurance Market 2020 2024 Evolving Opportunities With Allianz Group And American International Group Inc Technavio Business Wire

Global Marine Insurance Market 2020 2024 Evolving Opportunities With Allianz Group And American International Group Inc Technavio Business Wire

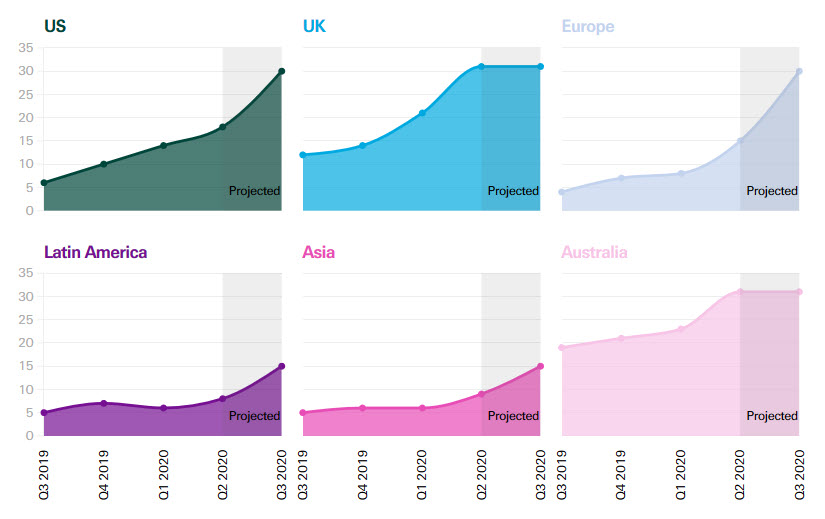

Make Sense Of The Insurance Market Australian Insurance Solutions Pty Ltd

Make Sense Of The Insurance Market Australian Insurance Solutions Pty Ltd

Insurance Policy Cycle Everything You Need To Know About Insurance Policy Cycle Crop Insurance Life Insurance Companies Insurance Policy

Insurance Policy Cycle Everything You Need To Know About Insurance Policy Cycle Crop Insurance Life Insurance Companies Insurance Policy

Motor Market Set For Underwriting Losses As Soft Market Hits Hard Online Only Insurance Times

Motor Market Set For Underwriting Losses As Soft Market Hits Hard Online Only Insurance Times

2020 Hard Market Trend Report The Insurance Pendulum

2020 Hard Market Trend Report The Insurance Pendulum

Risk Mitigation Plan Template Beautiful Risk And Mitigation Plan Template Template Design How To Plan Templates Sorority Recommendation Letter

Risk Mitigation Plan Template Beautiful Risk And Mitigation Plan Template Template Design How To Plan Templates Sorority Recommendation Letter

U S Commercial Property Insurance Rates Rise 21 In Q1 2020 Artemis Bm

U S Commercial Property Insurance Rates Rise 21 In Q1 2020 Artemis Bm

Understanding The Current Insurance Cycle Lockton Uk

Understanding The Current Insurance Cycle Lockton Uk

Insurance 2020 A Quiet Revolution The Future Of Insurance M A Institute For Mergers Acquisitions And Alliances Imaa

Insurance 2020 A Quiet Revolution The Future Of Insurance M A Institute For Mergers Acquisitions And Alliances Imaa

Global Marine Insurance Market 2020 2024 Evolving Opportunities With Allianz Group And American International Group Inc Technavio Business Wire

Global Marine Insurance Market 2020 2024 Evolving Opportunities With Allianz Group And American International Group Inc Technavio Business Wire

In Charts Economic And Insurance Outlook 2021 Swiss Re

In Charts Economic And Insurance Outlook 2021 Swiss Re

Project And Portfolio Management Software Business Planning Finance Content Marketing

Project And Portfolio Management Software Business Planning Finance Content Marketing

Why Is The Insurance Market Hardening Mckenzie Ross

Why Is The Insurance Market Hardening Mckenzie Ross

Hard Market Vs Soft Market The Insurance Industry S Cycle And Why We Re Currently In A Hard Market Pasar Sulit Vs Pasar Mudah Dalam Industri Asuransi Cepagram

Hard Market Vs Soft Market The Insurance Industry S Cycle And Why We Re Currently In A Hard Market Pasar Sulit Vs Pasar Mudah Dalam Industri Asuransi Cepagram

Post a Comment for "Insurance Rate Hardening"