Insurance Reimbursement Ifrs

Dr Insurance receivable debtor 4500 5000-500 Cr Insurance income 4500 So you have insurance income of 4500 credit versus the repair cost expense of 5000 which means your business lost 500 on this whole thing. 12302020 Insurance proceeds to settle a provision are accounted for as reimbursements under IAS 37 Provisions Contingent Liabilities and Contingent Assets and are recognised as a separate asset with related income when recovery is virtually certain.

Calameo Ifrs 17 Insurance Contracts

Calameo Ifrs 17 Insurance Contracts

Under IFRS the related reimbursement is recognized as a separate asset when recovery is virtually certain.

Insurance reimbursement ifrs. The reimbursement shall be treated as a separate asset. IFRS 17 Insurance Contracts Effective Date Periods beginning on or after 1 January 2023 R Page 1 of 6 DEFINITIONS Insurance risk Risk other than financial risk transferred from the holder of a contract to the issuer. The reimbursement shall be treated as a separate asset.

Hope that makes sense. IFRS Disclosure of IAS 37 Provision Liabilities and Assets An entity may expect reimbursement of some or all of the expenditure required to settle a provision for example through insurance contracts indemnity clauses or suppliers warranties. 53 Where some or all of the expenditure required to settle a provision is expected to be reimbursed by another party the reimbursement shall be recognised when and only when it is virtually certain that reimbursement will be received if the entity settles the obligation.

While investment contracts with discretionary participation features are financial instruments they continue to be treated as insurance contracts as permitted by IFRS 4. The reimbursement asset cannot exceed the related provision amount. Insurance proceeds to settle a provision are accounted for as reimbursements under IAS 37 Provisions Contingent Liabilities and Contingent Assets and are recognised as a separate asset with related income when recovery is virtually certain.

The Committee received a request to clarify the timing of recognition of compensation for insured property plant and equipment PPE that has been impaired or lost for example as a result of a natural disaster. Sometimes the insurance company will pay you less than the amount you paid. The recognition requirements for this type of.

The reimbursement shall be recognised when and only when it is virtually certain that reimbursement will be received if the entity settles the obligation. An asset relating to an insurance recovery should be recognized only when realization of the claim is deemed probable and only to the extent of the related loss recognized in the financial statements. Sometimes entities have right to reimbursement of related expenditures by the third party eg.

Record a loss on the insurance settlement. Credit insurance that provides for specified payments to be made to reimburse the holder for a loss it incurs because a specified debtor fails to make payment when due Product warranties other than those issued directly by a manufacturer dealer or retailer. 10302020 An insurance contract may also transfer financial risk but is accounted for as an insurance contract if the insurance risk is significant.

Natural disasters Insurance recoveries and reimbursements discusses the IFRS accounting between several standards and the reporting for a natural disaster and the insurances involved. Issuer has previously asserted explicitly that it regards such contracts as insurance contracts and has used accounting applicable to insurance contracts. From an insurance companyIn this case a right to reimbursement is recognized as a separate asset no netting off with the provision itself but you can net off the expenses for provision with the income from reimbursement in the profit or loss.

992011 IAS 16 Recognition of insurance recoveries new Date recorded. This usually happens when net book value of the property book value minus accumulated depreciation is more than the amount reimbursed. Financial risk The risk of a possible change in one or more of a specified interest rate financial instrument price commodity price currency exchange rate index of.

In this case either IAS 39 or IFRS 4 Insurance contracts may be applied. 572020 A potential insurance recovery should be evaluated and accounted for separately from the related loss and should not in any way affect the recorded amount of the loss. IASB International Accounting Standards.

The objective of IFRS 17 is to ensure that an entity provides relevant information that faithfully represents those contracts. And then for the insurance reimbursement record this separately. An entity may experience a loss related to a natural disastereither through the impairment of an asset or the incurrence of a liability.

Insurance proceeds to settle a provision are accounted for as reimbursements under IAS 37 Provisions Contingent Liabilities and Contingent Assets and are recognised as a separate asset with related income when recovery is virtually certain. 2102017 International Financial Reporting Standards IFRS Foundation. IFRS 17 Insurance Contracts establishes the principles for the recognition measurement presentation and disclosure of Insurance contracts within the scope of the Standard.

Certain legal claims may be subject to reimbursement in the form of insurance proceeds indemnities or reimbursement rights such as in these examples. The amount recognised as a reimbursement right is limited to the amount of the related provision. 3302020 Insurance proceeds may reimburse some or all of the expenditure necessary to settle the provision.

Ifrs 9 Financial Instruments Quick And Best Snapshot Annual Reporting

Ifrs 9 Financial Instruments Quick And Best Snapshot Annual Reporting

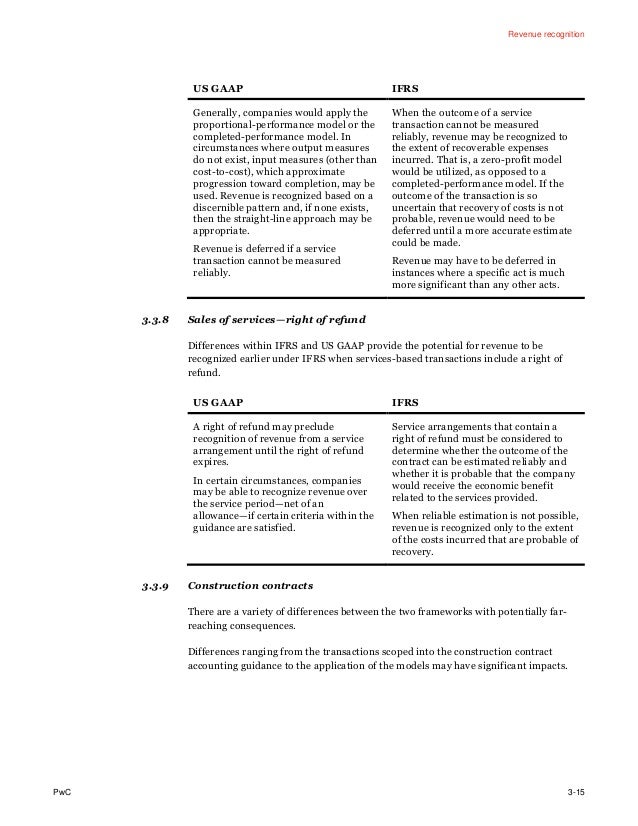

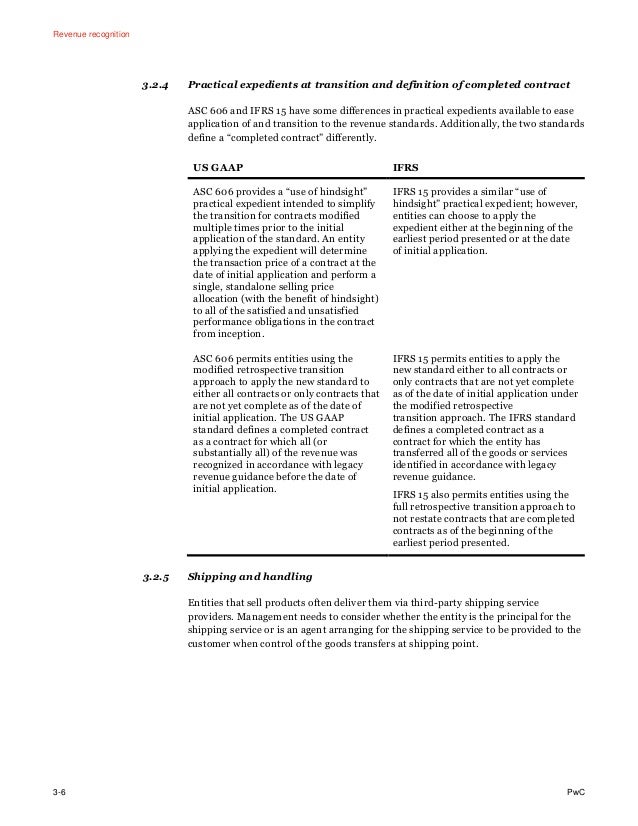

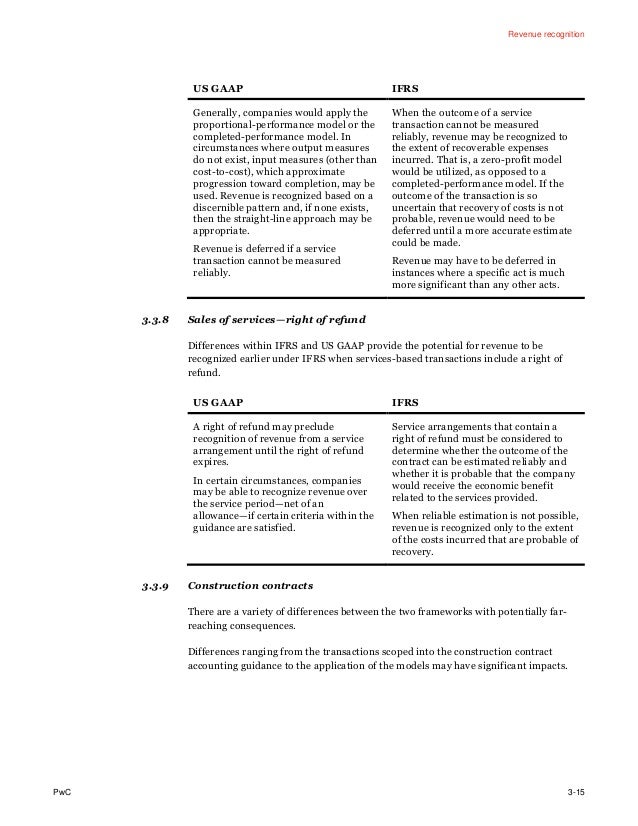

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ppt Ifrs 2 Accounting Powerpoint Presentation Free Download Id 549331

Ppt Ifrs 2 Accounting Powerpoint Presentation Free Download Id 549331

Financial Accounting Standards Ifrs 3 Business Combinations Financial Accounting Resource Management Financial Instrument

Financial Accounting Standards Ifrs 3 Business Combinations Financial Accounting Resource Management Financial Instrument

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Agenda Paper 13a Ifrs Interpretations Committee Work In Progress

Agenda Paper 13a Ifrs Interpretations Committee Work In Progress

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

The Key Accounting Implications Arising From Natural Disasters

The Key Accounting Implications Arising From Natural Disasters

Ifrs 9 Financial Instruments Quick And Best Snapshot Annual Reporting

Ifrs 9 Financial Instruments Quick And Best Snapshot Annual Reporting

C H A P T E R 13 Current Liabilities Provisions And Contingencies Intermediate Accounting Ifrs Edition Kieso Weygandt And Warfield Ppt Download

C H A P T E R 13 Current Liabilities Provisions And Contingencies Intermediate Accounting Ifrs Edition Kieso Weygandt And Warfield Ppt Download

Ifrs 9 Financial Instruments Mnp Llp 9 Financial Instruments Last Updated Fl Equity Instrument Fi Classified As Ei Under Ias 32 Holder Still Applies Ifrs 9

Ifrs 9 Financial Instruments Mnp Llp 9 Financial Instruments Last Updated Fl Equity Instrument Fi Classified As Ei Under Ias 32 Holder Still Applies Ifrs 9

Ppt Ifrs 2 Accounting Powerpoint Presentation Free Download Id 549331

Ppt Ifrs 2 Accounting Powerpoint Presentation Free Download Id 549331

Ifrs 9 Financial Instruments Quick And Best Snapshot Annual Reporting

Ifrs 9 Financial Instruments Quick And Best Snapshot Annual Reporting

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Wiley Interpretation And Application Of Ifrs Standards Money Book Ebook Pdf Books Download

Wiley Interpretation And Application Of Ifrs Standards Money Book Ebook Pdf Books Download

Ifrs 9 Derivatives And Embedded Derivatives Financial Instrument Economic Environment Financial Asset

Ifrs 9 Derivatives And Embedded Derivatives Financial Instrument Economic Environment Financial Asset

Ppt Ifrs 2 Accounting Powerpoint Presentation Free Download Id 549331

Ppt Ifrs 2 Accounting Powerpoint Presentation Free Download Id 549331

Post a Comment for "Insurance Reimbursement Ifrs"