Car Insurance Liability Coverage Ontario

In that case payment for property damage will be capped at 10000. As your trusted brokerage we believe its our duty to ensure you have superior home and auto insurance coverage.

Basic Vs Optional Auto Insurance Coverage In Ontario Mitchell Whale Ltd

Basic Vs Optional Auto Insurance Coverage In Ontario Mitchell Whale Ltd

If youre at-fault in a car accident your liability coverage helps cover the cost of legal expenses arising from damages caused to other drivers pedestrians or property up to your policy limit.

Car insurance liability coverage ontario. All Ontario drivers must. On your next renewal you may notice your liability limit increased to 2 million. Its used specifically if the motor vehicle injures or kills someone or damages someones property through the fault of the driver.

Liability insurance is a mandatory coverage that must be included on your car insurance policy in order to legally drive a vehicle in Canada. This covers you in the event that you injure or kill someone or damage someones property. Liability Coverage civil liability coverage in Quebec protects you financially if you are legally liable for injuring someone or causing damage to another persons property or automobile while operating a motor vehicle.

Under FSCO rules all Ontario drivers must carry at least 200000 in third party liability coverage. Third Party Liability Coverage - This type of insurance covers you if you cause an accident that hurts or kills another person or causes property damage to their car. The liability portion of your car insurance policy will extend to your trailer if and while its being towed.

In Ontario the law states that all drivers must carry liability insurance it is mandatory. Liability insurance is mandatory coverage for an automobile policy. Third-party liability is one of the three mandatory types of auto insurance in Ontario and most parts of Canada.

Liability coverage car insurance is a type of coverage that your insurer would pay out toward the cost of damage you may cause to others when driving. 182021 This coverage pays for losses caused when an insured vehicle is involved in an accident with another object including another vehicle or rolls over. Its important to ensure that your trailer is hitched appropriately.

Please refer to the list of sources for more details. 9112019 Important note your liability insurance does notcover the cost to repair your own car or pay your medical bills. What is Liability Car Insurance.

Your third-party liability auto insurance questions answered. 592012 Ontario has compulsory automobile insurance. When you are using or operating your car.

Third-party liability car insurance prevents you from paying for the damage out-of-pocket and is the only type of car insurance thats mandatory across Canada. If you are found driving without valid auto insurance you can have your drivers licence suspended and your vehicle impounded. You may need more than the minimum set by your provice or territory.

19 rows What is the minimum coverage for auto insurance in Ontario. In Ontario you are expected to carry active car insurance coverage if you drive. The coverage is specifically meant for the insured driver andor owner of the vehicle.

Another vehicle or a trailer that is attached to the vehicle that is covered by your policy. Depends on province or territory. Finally the third type of mandatory coverage that all vehicle owners in Ontario must have in their policy is called Uninsured Automobile Coverage This type of coverage protects you if you are involved in an accident with an unidentified vehicle for example a hit and run accident or with an uninsured driver who causes vehicle damage.

The chart below provides a summary of minimum coverages required by the Ontario government. It must include liability coverage. In Ontario 200000 is the minimum mandatory liability amount available for any one accident.

The surface of the ground and any object in or on the ground says FSCO. This means its deemed road worthy and all indicator lights and break lights are fully functional. What is the minimum third-party liability car insurance coverage in Ontario.

Fines for vehicle owners lessees and drivers who do not carry valid auto insurance can range from 5000 to 50000. 11212019 Thats why you need to be prepared for the off-chance you cause an accident that results in property damage or injuries. However suppose a claim involving both bodily injury and property damage reaches this figure.

This is coverage designed. Ontario law requires that all motorists have auto insurance. It covers any damages to property or another person due to an auto accident.

Auto Insurance - Its the Law. The minimum coverage for liability coverage is 200000 in Ontario but you may increase your limit. This means that every vehicle registered in the province must be insured for third party liability of at least 200000.

To drive in Ontario you must secure coverage through a private insurer that meets the minimum provincial regulations. In the province 200000 in third-party liability coverage is mandatory. At Youngs Insurance we are recommending that our clients carry a minimum of a 2 million liability limit to protect their interests.

As the name suggests liability covers damages caused to others. In Ontario it is mandatory for all motorists to have active standard car insurance.

My Best Insurance Quote Email Template Insurance Quotes Home Insurance Quotes Insurance Quotes Best Insurance

My Best Insurance Quote Email Template Insurance Quotes Home Insurance Quotes Insurance Quotes Best Insurance

Do You Have To Have Insurance To Buy A Car

Do You Have To Have Insurance To Buy A Car

Verkehrsunfall Sorgfaltspflichtverletzung Des Linksabbiegers Olg Frankfurt Az 22 U 148 11 Urteil Vom 28 0 Car Insurance Cheap Car Insurance Insurance

Verkehrsunfall Sorgfaltspflichtverletzung Des Linksabbiegers Olg Frankfurt Az 22 U 148 11 Urteil Vom 28 0 Car Insurance Cheap Car Insurance Insurance

Insurance Rates For Vehicle Types

Insurance Rates For Vehicle Types

Types Of Car Insurance Coverages Types Of Insurance Coverage For Cars Types Of Insurance Coverage For Auto Car Insurance Car Insurance Tips Insurance Marketing

Types Of Car Insurance Coverages Types Of Insurance Coverage For Cars Types Of Insurance Coverage For Auto Car Insurance Car Insurance Tips Insurance Marketing

Product Recall Insurance Is Typically For Product Manufacturers Or Merchandisers That Need Financial Coverage In The Car Insurance Recall Independent Insurance

Product Recall Insurance Is Typically For Product Manufacturers Or Merchandisers That Need Financial Coverage In The Car Insurance Recall Independent Insurance

Five Various Ways To Do Liability Insurance Coverage Liability Insurance Coverage Liability Insurance Insurance Liability

Five Various Ways To Do Liability Insurance Coverage Liability Insurance Coverage Liability Insurance Insurance Liability

Car Insurance Ontario Blog Otomotif Keren

Car Insurance Ontario Blog Otomotif Keren

Ontario S 10 Most Expensive Cities For Car Insurance James Campbell

Ontario S 10 Most Expensive Cities For Car Insurance James Campbell

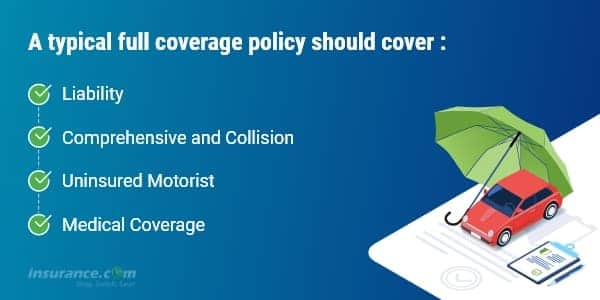

Full Coverage Car Insurance Cost Of 2020 Insurance Com

Full Coverage Car Insurance Cost Of 2020 Insurance Com

Laibility Insurance Quotes For First Time Drivers Liability Vs Full Coverage What You Need To Know Cover Dogtrainingobedienceschool Com

Laibility Insurance Quotes For First Time Drivers Liability Vs Full Coverage What You Need To Know Cover Dogtrainingobedienceschool Com

Reasons Why Check My Car Insurance Price Is Getting More Popular In The Past Decade Check My Car Insurance P Compare Insurance Insurance Quotes Car Insurance

Reasons Why Check My Car Insurance Price Is Getting More Popular In The Past Decade Check My Car Insurance P Compare Insurance Insurance Quotes Car Insurance

5 Steps How To Get Cheap Car Insurance Infographic Car Insurance Tips Car Cheap Infographic Insurance Steps Tips

5 Steps How To Get Cheap Car Insurance Infographic Car Insurance Tips Car Cheap Infographic Insurance Steps Tips

18 Innovative How Much Does Car Insurance Cost Tinadhcom Car Insurance Insurance Quotes Auto Insurance Quotes

18 Innovative How Much Does Car Insurance Cost Tinadhcom Car Insurance Insurance Quotes Auto Insurance Quotes

How To Choose A General Liability Insurance Plan General Liability Business Insurance Business Liability Insurance

How To Choose A General Liability Insurance Plan General Liability Business Insurance Business Liability Insurance

Post a Comment for "Car Insurance Liability Coverage Ontario"